The big central bankers vindicated their status as those responsible for monetary policy last weekend and maintained a restrictive tone in their interventions, implying that it is still too early to rule out interest rate hikes in the United States and the euro area in this cycle.

However, the market consensus collected by Bloomberg ignores the words expressed in Jackson Hole and maintains its position: the ceiling would have already been seen in the reference of the European Central Bank and the Federal Reserve.

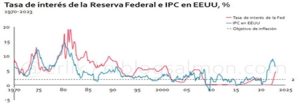

In the case of the US, the current 5.5% would be the maximum, according to the experts, and even if it remained unchanged at the September meeting, in the long run the rate cut would be the most likely. In fact, now it is considered that by the start of 2025 the rates would be 100 basis points below the current ones, according to the evolution of the OIS swaps.

We believe that [Fed Chairman Jerome Powell's] hawkish tone was primarily aimed at dispelling residual hopes of a rapid rate cut. We maintain our opinion that there will be no more increases”, estimated the economist of Generali Investments, Paolo Zanghieri. According to the expert, only a rise in the CPI in the US or some "good and surprising" employment reports could prompt the Federal Reserve to continue with the upward adjustment of its monetary policy.

However, the market forecasts collected by Bloomberg have come to consider a much faster cut than currently seen. “As GDP momentum has been firmer recently, we now see less scope for rate cuts,” said David Page, head of macroeconomic research at AXA IM.

Neither did Christine Lagarde's words come as a surprise nor did they alter the forecasts of the experts. However, the possibility of seeing a rise in the next ECB meeting is higher than in the case of the Fed, although they are not a majority either. Of course, neither of the two central banks let them see the possibility of making their objective of reaching 2% inflation more flexible. Rates will fall to 4.5% by 2025.

Sergio Fernandez

Madrid 21:30 – 28/08/2023

The Economist